Dumping in the market: the risks of a market market

In today’s frantic cryptocurrency market, traders and investors are always looking for opportunities to create quick profits. A popular strategy that is gaining traction is becoming a market taker **, which provides for the purchase and sale of cryptocurrencies in a way that uses market fluctuations.

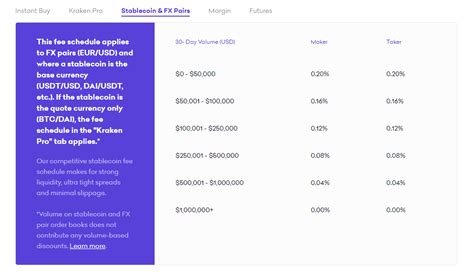

One of the most famous platforms used by market buyers is Kraken. Founded in 2011, Kraken is a reliable on -line broker that provides traders access to over 200 cryptocurrencies, including popular tokens such as Bitcoin, Ethereum and Litecoin. With its robust platform, intuitive interface and competitive prices, it is not being surprised because many traders have chosen Kraken as a reference platform for market taking.

So what exactly implies being a market player **? In a nutshell, it means buying a cryptocurrency for the opening price of an exchange and sells it for the closing price. This strategy uses the fact that most cryptocurrencies tend to move in conjunction with other activities during bags, such as actions and future. When buying and selling discharge, market buyers can maximize their profits by minimizing losses.

However, being a market taker ** also arrives with its right risks. One of the biggest concerns is that market volatility can quickly transform to the most planned operations into a disaster. While the cryptocurrency market moves rapidly, market buyers should be prepared to adapt and adapt their strategies to agreement. This means that continuously monitoring of market trends, remaining up to date on regulatory changes and willing to take bold shares when the opportunity is presented.

Another important consideration for

market taker is the concept of “dumping”. The exhaust refers to a strategy in which traders sell a cryptocurrency at a swollen price to recover it after a lower price. This approach can be profitable if performed correctly, but also has significant risks. If the market suddenly wages or cryptocurrency is a huge increase in value, the market player

may face significant losses.

Kraken positions himself as well as a defender of traders and intelligent investors who are willing to take calculated risks. In fact, Kraken offers a number of features and tools that help traders sail the complexity of market intake and eviction. This includes advanced risk management strategies, automated trading platforms and a solid support system for specialized beginners and traders.

However, it is essential for any market participant ** or merchant remember that market volatility is intrinsically unpredictable. While Kraken offers an excellent platform for operating operations, there is no guarantee of success. To minimize risks, it is essential to ensure the cryptocurrency market, remain informed about regulatory changes and develop a solid negotiation strategy.

In conclusion, it becomes a market taker ** requires a profound understanding of the cryptocurrency market, as well as the desire to assume calculated risks. By doing due diligence, using robust commercial platforms like Kraken and being prepared for unexpected, traders can maximize their profits by minimizing their losses.