Trends of capitalization of cryptocurrency market and isolated margin considerations

The cryptocurrency market has registered significant increase and volatility in recent years, with prices rapidly fluctuating between maximums and minimum values. A key factor that affects the performance of a cryptocurrency is its fundamental evaluation, which is determined by various factors, such as supply and demand, adoption rates and market feeling.

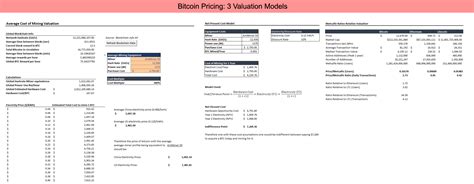

Fundamental assessment of cryptocurrency

The fundamental value of a cryptocurrency is determined by the amount of money it can generate through its operations, such as transaction taxes, income from transaction volume and profit margins. This assessment is influenced by several key values including:

- Transaction volume : The more transactions that appear on a blockchain network, the greater the increased value potential.

- Offer and request : a balanced offer and a request for cryptocurrency can lead to stable prices and increase its demand, increasing its value.

- Adoption rate

: As more people adopt cryptocurrencies, use cases and investment opportunities increase, increasing the price.

- Sent of market : The general feeling of the market, including investor confidence and uncertainty, also affects the value of a cryptocurrency.

Trend lines on cryptocurrency market

The tendency lines are used to identify the support and resistance areas on the financial markets. In the context of cryptocurrencies, the tendency lines can help investors to determine where to buy or sell based on historical data and impulse. There are several types of trend lines that can be applied to cryptocurrency market, including:

- Mobile (MA) media : These are calculated media of a pricing series for a certain period, used as an indicator of short -term trends.

- Relative resistance index (RSI) : This is an impulse indicator that measures the power of recent price changes to determine over -stated or surveillance conditions.

TRADATION OF THE Isolated Marriage

The trading of the isolated margin is a high risk strategy, which involves the loan of the margin of a trader without holding any position on an exchange and the simultaneous purchase or selling assets with borrowed funds. This approach can amplify potential earnings, but it also increases the risk of losses if the market moves against the trader.

In the trading of the isolated margin, traders use online platforms or brokerage that offers this feature. Key benefits include:

- Leverage : Isolated margin allows traders to control larger positions with less capital.

- Increasing profit potential : With a higher effect is the potential of significant profits if the market conditions are favorable.

However, the isolated margin trading also presents risks, including:

- margin calls : If the trader’s position is not accepted by sufficient guarantee, they may be obliged to submit more funds or risk liquidating existing positions.

- Market volatility : Cryptocurrency markets can experience rapid price changes, which makes traders difficult to maintain a stable margin.

Conclusion

The capitalization trends of the cryptocurrency market and the considerations on isolated margins are crucial factors that investors should consider when making trading decisions. The fundamental assessment of cryptocurrencies is essential in determining their potential value and identifying support and resistance areas. By understanding the lines of trend and using the isolated margin trading strategies, traders can make knowledge and increase the yield.

Do not forget to always perform thorough research and set realistic expectations before entering any trading or market environment.