Unlocking Crypto’s Potential: A Deep Dive into Fundamental Valuation, Hardware Wallets, and DeFi

The world of cryptocurrencies has undergone a significant transformation in recent years, with many players vying for dominance. As investors, users, and enthusiasts seek to capitalize on the growing market, it’s important to understand the underlying principles that drive value in different cryptocurrencies.

In this article, we’ll delve into three key areas: fundamental valuation, hardware wallets, and decentralized finance (DeFi).

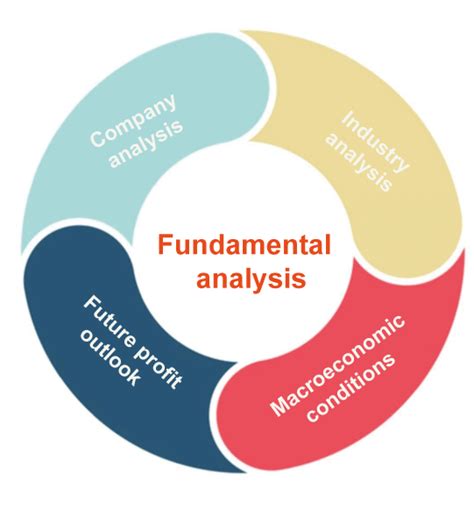

Fundamental Valuation: The Backbone of Cryptocurrency

Fundamental valuation refers to the analysis of a cryptocurrency’s intrinsic value, taking into account its underlying assets, revenue streams, profitability, and competitive position. This approach helps investors and analysts determine whether a particular cryptocurrency is undervalued or overvalued.

When assessing fundamental valuation, it’s crucial to consider the following factors:

- Revenue Streams: How does a cryptocurrency generate revenue? Is it through transaction fees, advertising, or subscription-based models?

- Market Capitalization: What is the total market capitalization of the cryptocurrency? A higher market capitalization often indicates a more established brand and greater growth potential.

- Adoption Rate: How widely the cryptocurrency is being adopted by users, developers, and institutional investors?

- Supply and Demand: Are there sufficient supply and demand forces driving the price of the cryptocurrency up or down?

Some of the most highly valued cryptocurrencies in recent years include Bitcoin (BTC), Ethereum (ETH), and altcoins like Litecoin (LTC) and Dogecoin (DOGE).

Hardware Wallets: Safe and Reliable Cryptocurrency Storage

Hardware wallets are digital storage solutions that store cryptocurrencies offline, keeping them safe and anonymous. These wallets have gained a lot of popularity in recent years due to their ease of use and reliability.

When choosing a hardware wallet, consider the following factors:

- Security: Look for wallets with strong encryption methods, secure protocols (e.g. two-factor authentication), and regular software updates.

- Compatibility: Make sure the wallet is compatible with your operating system and cryptocurrency.

- User Interface: Choose a user-friendly interface that makes it easy to manage your coins.

Some popular hardware wallet options include Ledger, Trezor, and KeepKey.

Decentralized Finance (DeFi): The New Era of Financial Inclusion

Decentralized finance has revolutionized the way we think about managing money, allowing users to participate in financial transactions without the need for intermediaries. DeFi platforms have democratized access to financial services, providing an alternative to traditional banking models.

When considering DeFi options, consider the following factors:

- Liquidity: How liquid is the platform? Can users easily deposit and withdraw funds?

- Interest Rates: What interest rates are offered on DeFi lending or staking platforms?

- Fees

: Are there any hidden fees or transaction costs?

- Regulation: Are DeFi platforms subject to regulatory oversight?

Some notable DeFi projects include Compound, Aave, and MakerDAO.

Conclusion: Unlocking the Potential of Cryptocurrencies

Cryptocurrencies have come a long way since their inception, and fundamental valuation remains an essential aspect of investing in this space. By understanding the intricacies of cryptocurrency fundamentals, the security of hardware wallets, and the rise of DeFi, investors can make more informed decisions and potentially reap the rewards.

However, it’s important to remember that cryptocurrency markets are inherently volatile, and prices can fluctuate wildly.