“Dynamics of the cryptocurrency market: understanding of the dowel, fees and positions”

The cryptocurrency market is known for high variability and fast price fluctuations, which makes it an exciting space for investing. However, navigation on this market requires a deep understanding of various components that contribute to its dynamics.

The heart of every cryptocurrency exchange is a currency, also known as “PEG rate”. PEG currencies are a permanent exchange rate between two currencies, ensuring that the value of one currency remains stable in relation to another. For example, bitcoins and American dollars are often set at 1: 1, which means that $ 100 in Bitcoin is equivalent to USD 100 in USD.

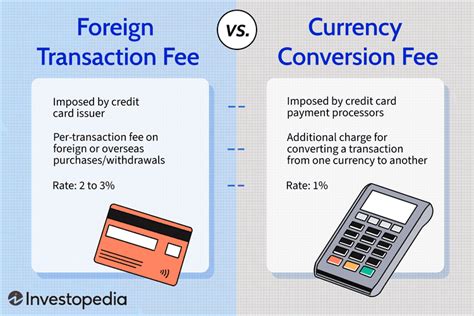

However, the price stability provided by PEG currencies can be disturbed when the exchange of cryptocurrencies imposes transaction fees. Transactions fees represent the costs of processing each transaction on the stock exchange, which can consume the profitability of buying and selling cryptocurrencies. For example, if you buy 1000 bitcoins each $ 10,000 per unit, and then sell them for $ 5,000 after paying a transaction fee of USD 200, net profit would be minus USD 300.

One of the common strategies used by traders is taking long positions in cryptocurrencies, betting that the price will increase. The long position is to buy assets with waiting for sales at a higher price. For example, if you think that the price of bitcoins will increase and buy 1000 pieces initially for USD 10,000 per unit, you will sell them for USD 15,000 after six months to make a profit.

To illustrate this strategy, let’s consider the example of long purchase and holding:

- Initial investment: 100,000 USD

- Item size: 1000 units

- Long position (purchase): Buy 1000 Bitcoins each $ 10,000 per unit.

- Expected price increase: $ 5,000 (increase by 50%)

- Sales point: Sell 1000 pieces for USD 15,000 after six months.

In this scenario, your net profit would be USD 3500 (USD 15,000 – $ 11,500).

Understanding dowels and currency fees

While the currency dowel can ensure the stability of the cryptocurrency market, it should be understood that even with a set exchange rate, prices can still change. This variability is partly caused by external factors such as global events, economic conditions and supply imbalance.

Similarly, transactions fees can significantly affect the profitability of the individual during cryptocurrency trading. The more you trade, the higher the transaction fee will be.

To reduce this risk, traders often use various strategies, including:

- Diversification: Dissemination of investments in various resources to reduce relying on the single market or strategy.

- Orders for Stop-Loss: Setting the limits of potential losses if prices are moving against you.

- Security strategies: Use of derivatives such as Futures contracts to block position and protect against price fluctuations.

To sum up, the cryptocurrency market is powered by complex dynamics covering currency pins, fees for transactions and trade strategies. Understanding these factors can help traders more effectively move around space, but it is key to maintaining a sustainable approach, diversification of investments and careful risk management.

Remember that investing in cryptocurrencies includes an inseparable risk, including price variability, regulatory changes and market manipulation. Always conduct thorough tests, set clear goals and never invest more than you can afford a losing.